Life is full of surprises. Do you have unexpected costs, an unforeseen expense, or urgent money problems?

Payday loans in Canada let you temporarily deal with a financial worry and are undoubtedly the optimal solution to resolve your situation. Thanks to this loan, you don’t find yourself strapped for cash until your next paycheck.

Once you secure a payday loan, you receive money very quickly, which you will have to pay back on your next regular payday. Like many Canadians, you can get funds quickly thanks to this express loan—a service that no traditional banking institution offers.

When to get a Payday loan in Canada?

Do you need to have your vehicle repaired urgently? Do you have non-covered healthcare expenses or an overdue bill to pay?

These types of situations always happen unexpectedly. If you take out a loan immediately, you can face this problem and move on. Remove this burden weighing on your shoulders and submit your loan application online immediately!

Expenses you can pay with a payday loan

For most of us, making it to the next paycheck has been a challenging endeavour. Living standards are not at their best, and most of us have learned to survive with what we get.

But there is no one lasting solution for this. Unexpected expenses occur, and all of a sudden, you need to pay a hospital bill, get your car fixed, or even pay an overdue utility bill that you almost forgot about.

Pay unexpected expenses with Send Me Cash Now

It becomes an issue if these financial challenges come when you haven’t received your payslip. Luckily, there are online payday loans in Canada that can help anyone faced tough times.

It is no guarantee that you’ll have cash flow all the time. Even when you set aside some money, you can’t plan for the unexpected. Situations like this can be stressful. But that’s where payday online loans come in!

Payday loans in Canada to face financial challenges

Payday online loans help Canadian residents relieve the financial challenges that occur when their paycheck has not yet arrived. If you need quick cash, online loans can help you. Plus, payday loans are completely online.

The approval time is also fast, and we will give you a response in a matter of minutes. Finally, if you need to offload financial baggage, payday loans can help.

Need a loan for any project ?

What is a Payday Loan?

A payday loan is a short-term loan that helps people come out of an unexpected situation such as urgent home repair, fixing cars, etc. until they get their next payday. The loans are given for a short period, no more than 14 days. At Send Me Cash Now we know that you are cash-strapped and our experts will give you a loan according to your level of need. Unlike most loans in Canada, payday loans are not reliant on collateral or credit scores but rather proof of income and an active bank transaction history.

Payday loans to solve short-term financial problems

Unlike cash advance, you can choose to pay the payday loan in installments or all together when you receive your paycheck. Remember, online loans are only meant to solve a short-term financial issue and are best used when you have urgent financial issues. The loans are excellent at helping in such situations, and at Send Me Cash Now, we’ll give you the best payday loan with a reliable cost of borrowing.

How Does Online Payday Loans Work?

Generally, a payday loan is an agreement to lend an individual some money they’ll agree to pay in installments or in full once they get their next income. Payday loans have a higher cost of borrowing than most loans like cash advance because of their unsecured nature. Since the payday loan is not reliant on any assets of the borrower, the online lender assumes a lot of risks. To compensate for this risk, payday lenders have to charge a higher interest rate.

Get $300 to $3000 with Send Me Cash Now

Payday loans do not give as much money as other financial institutions. The loans are provided by retail stores or non-bank institutions registered with the Financial and Consumer Services Commission. Payments for these loans are structured to be paid in pre-authorized electronic debit or post-dated cheques. The repayment can either be full or partial, depending on the payday loan agreement.

Perks Of Payday Loans in Canada

Payday Loans are very useful in many cases, here are some of the benefits of payday loans in Canada:

Flexible spending

Payday loans are not like auto loans or mortgage loans. You can spend loans to solve any financial issues without being restricted by your lender. For instance, in mortgage loans, you need to spend the money on paying for your home alone. Auto loans are also restricted to paying for car expenses only and cannot be used on a friend or family’s car.

Limited requirements

Personal loans in Canada have low entry barriers, and as long as you are above 18 years and can show a consistent, verifiable income, you’re eligible. Besides, most collateral loans require individuals to bring some collateral to secure the loan. On the other hand, online loans are unsecured and do not require any collateral except your income and cash flows.

Fast approval

Apart from having limited requirements, online loans will process your money fast and with no delay times. The good thing is, the money will be deposited through e-transfer to your account.

Easy access

Gone are the days when you had to file pages of documents and go for unlimited appointments to secure a loan. Things have transformed digitally, and you can access loans easily. That said, payday loans in Canada are online and can be completed by anyone who has internet access from anywhere. It is a huge time-saver and reduces the costs of commuting to a physical location.

No credit check payday loans

Unlike most online loans, payday loans in Canada do not have stringent credit checks as loan requirements. While the lender may ask for a credit score, it does not necessarily mean that they’ll use it to give you loans. Folks with bad credit scores can still receive loans.

Need a loan for any project ?

How To Apply For Payday Loans in Canada

The application process for payday online loans is relatively easy. All you need is to follow a few guidelines. Here are the required steps to apply online for payday loans in Canada:

- Register online

- Fill out information

- Verification and approval

- Receive funds

- Repayment

1. Register online

The initial step is to fill out an application form, it allows our experts to identity you, and to know who needs a payday loan.

2. Fill out information

Once you register an account with us, you’ll be given a form to fill in and verify certain information about yourself when you ask for a payday loan. The information required are:

- Personal identification: enter your names, phone number, and place of residence.

- Reason for borrowing: mortgage due, accident, utility bills, etc.

- Banking details: enter bank information you intend to receive money.

3. Verification and approval

The lender will give you a call or email to verify the details provided in the application form. The approval process is quick and can take at most 24 hours. Some credit checks will be amazingly fast, and you can get your cash instantly. The process is faster because there are no credit checks needed.

4. Receive the funds

The loan will be sent to your bank account through an ideal e-transfer method if the lender has approved your details. Once you receive the money, you can withdraw at any time and use it however you want.

6. Repayment

Finally, the next process, once you get the approval, you have to repay your loan. Here, the number and amount in installments, depending on how much we agreed. The repayment process follows guidelines provided by the Government of Canada.

Some people prefer a pre-automated payment method, where the bank debits your account once you get your paycheck. In this system, you need to specify your payment date. In other arrangements, people prefer to pay in person, which is most of the time not logistical. If you fail to pay the amount for some reason, the lender charges an NSF fee.

Need a loan for any project ?

Requirements for Payday Loans in Canada

As mentioned earlier, payday online loans in Canada have minimal requirements, accessible to anyone. However, even though each lender has its requirements, the general rules guiding these laws are the same. Here are some of the common requirements:

18 years old

Steady income

Canadian citizen

Bank account

Must attain the age of 18 years

To prove that you have attained this minimum age, you must provide government-issued identification. For example, passport, driver’s license, citizenship card, health card, etc.

Must have proof of steady income

You must show that you are employed in a company with a steady income to apply for payday online loans in Canada. To do this, you must provide proof of income with documents such as payslips or an income statement.

Must be a Canadian citizen

You must be a Canadian citizen and have documents to show it. You can do this by presenting your citizenship cards or birth certificate. However, birth certificates are not a mandatory requirement for proof of citizenship, and sometimes a proof of permanent residency is sufficient.

Must have a bank account

Since all payday loans are transferred online, it is important to have a bank account to receive funds and check income proof. In addition, the same account will also be used to deduct payments from your installments.

Legal Structure Of A Payday Loans in Canada

To protect borrowers and lenders, payday online loans are governed by the Payday Loans Act, 2008, which was created to protect borrowers getting these types of loans. The Act gives the following rights to loan borrowers in Canada.

- Insurance on the loan is optional

- Lenders are not allowed to offer or sell any additional goods and services along with the payday loan

- Lenders cannot surpass a certain fixed percentage of a borrower’s paycheque proceeds

- Borrowers are allowed to cancel loans within 2 business days without paying any penalty fees or giving a solid reason to the lender

Lender Loan Requirements

Payday loan providers are also required to have fulfilled certain requirements to be considered legal or operate a payday loan service in Canada. These requirements include:

License

Transparency

Payment

Borrow Practices

License & Regulation

The lender has to be registered with the Government of the province they intend to operate in and compliant with the Payday Loans Act, 2008 to be fully licensed.

Transparency

The lender needs to be transparent in giving out loans. Therefore, they must include all relevant information related to the loans, such as loan amount, repayment days, cost of borrowing, etc.

Payment

The lender is prohibited from getting payment by automatic deductions from the borrower’s paycheck.

Borrow Practices

The lender is not allowed to issue more than one payday loan to the borrower.

Need a loan for any project ?

Why you should trust us with your payday loan in Canada?

One perk about payday loans is their integrity and straightforward way of handling business. There are no hidden costs waiting for you or irregular costs of borrowing to wait for. However, since it is not a huge amount, you’re required to pay within a short time.

So, if you need quick cash, short-term loan is your best bet when doing so. Just come with your proof of income and a few payslips to us, and we will process your loans instantly.

Contact Send Me Cash Now for your Payday Loans in Canada

As you can see, traditional payday loans in Canada are easy to access and are beneficial to borrowers and small businesses. You only need to be aware of repayment dates as failure to do so may adversely impact your credit score.

If you have financial issues that may affect your repayment plan, be sure to contact and possibly arrange for a rescheduling of the repayment date. Send Me Cash Now is among the top providers of payday loans in Canada. Call us today or fill in an application form to get your money within 24 hours !

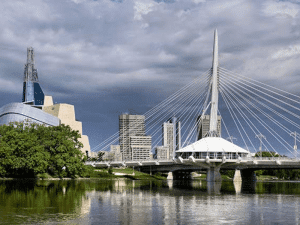

Provinces served in Canada | Payday Loans

Other cities served | Payday Loans

Need a loan for any project ?

Why rely on Send Me Cash Now?

An express loan

An amount tailored to your situation

A real desire to support you

Payday loan: apply now

Don’t waste time; free yourself from a burden by immediately submitting your payday loan application. The procedure is very simple, only takes a few minutes, and is done in a totally confidential and secure manner.